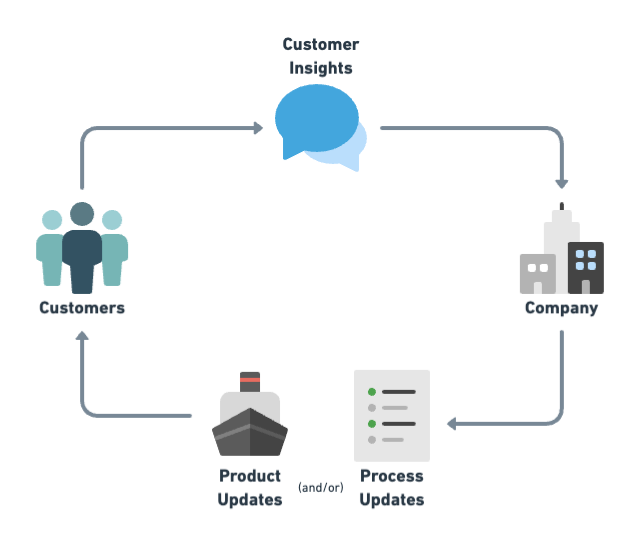

A Voice of the Customer program can help you maintain a strong understanding of what customers are thinking about your company and its products or services, and it can be a great way to get people from across a company collaborating together.

If you’re not familiar with the term Voice of the Customer, it’s a collection of systems and processes that can be used by your company to stay in tune with what customers are thinking, providing the team with insights that can be applied to product development plans, process improvements, and other types of changes.

Having the Voice of the Customer represented well in a company can mean the difference between solving the right problems vs. going in the wrong direction, and ultimately succeeding or failing. When things go in a negative direction here, outcomes could include a poor customer experience, increased churn, and lack of revenue growth, among other things.

To do Voice of the Customer well, a company needs to be coordinated and proactive.

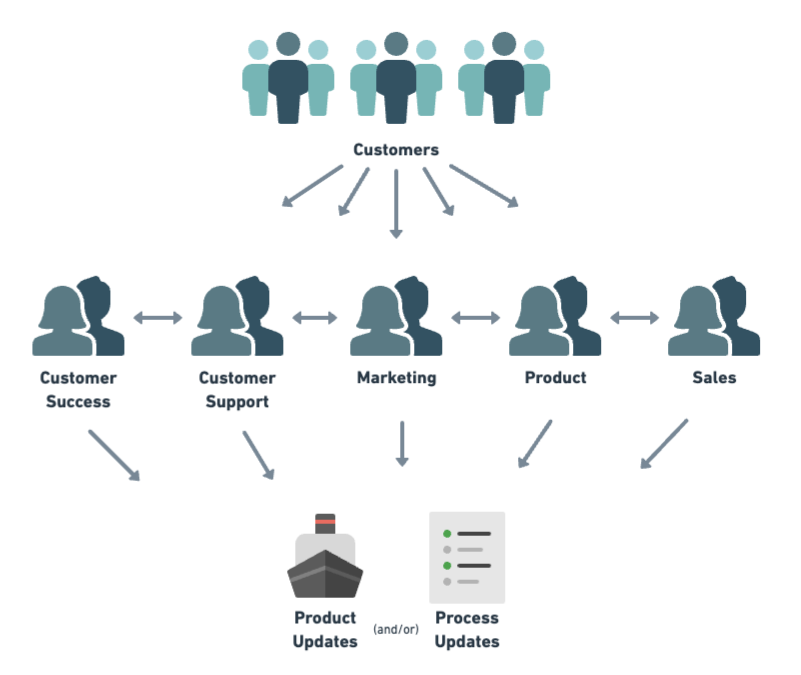

- Coordinated – Multiple departments should work together on collecting, analyzing, and actioning the data. Any function in a company that’s customer-facing or can leverage customer insights should be involved, such as Customer Success, Customer Support, Marketing, Product, and Sales. The value extends well beyond product development, and you can help a company capture that value by incorporating these kinds of functions.

- Proactive – You’ll end up with the best quality of insights by incorporating a variety of sources beyond only reviewing a passive communication channel like customer support tickets. This requires an investment of time and is worth it.

Depending on your company’s business model (e.g., B2B, B2C, B2B2C) and target market segments (e.g., SMB, Enterprise), some methods of getting customer insights may not make sense for the program.

Directly from customers / the market:

- Listen in on team member calls with customers & prospects (e.g., Customer Success, Customer Support, Partnerships / Business Development, Sales)

- 💡 Only 1 person from a team that’s not facilitating a call needs to join, such as 1 Product team member joining a call that the Sales team is doing

- Things might evolve into team member pairings between departments, such as Product Manager A collaborating with Salesperson A, Product Manager B collaborating with Customer Success Manager B, etc — and insights can be shared back among each team

- 💡 Only 1 person from a team that’s not facilitating a call needs to join, such as 1 Product team member joining a call that the Sales team is doing

- Review customer support tickets

- 💡 Your company’s Support team might already have a way to tag or categorize tickets to help identify common issues

- Analyze survey results (e.g., NPS, CSAT — or do a one-off survey)

- 💡 Some of the most useful data from standardized surveys like NPS (Net Promoter Score) is in the freeform text answers that customers can optionally submit

- Facilitate calls with customers for team research initiatives (e.g., product discovery, customer advisory council)

- 💡 As a Product person, you may already be doing things like this, but make sure you loop in other departments and contribute insights to the centralized Voice of the Customer program

- Read company/product review sites (e.g., Capterra, G2, App/Play Store)

Among team members within a company:

- Schedule recurring time on the calendar and include the whole company as optional invitees (e.g., a bi-weekly “Product Workshop” or “Office Hours”)

- 💡 I’ve run these from a Product perspective, but it could be facilitated by other departments/functions. A key is sharing useful info and inviting feedback, and it can naturally open up lines of communication and build more cross-functional involvement over time. I’ve written a bit more about this here.

- Periodically meet with members of other departments to hear about trends they’ve noticed and what they believe deserves attention (e.g., Customer Success, Customer Support, Sales)

- Review notes (or watch / listen to recordings) from team member calls with customers & prospects

- 💡 Keeping notes and recordings might already be a process among your team, and like many other situations, you’ll likely find the most success by providing a reason (focusing on the expected value) why people should share such things with you

Notes should be taken during any meeting, and consider recording meetings if there’s a larger audience that’d benefit from reviewing async.

💡 If you listen in on a call or watch a recording, take notes and share them with the facilitator of the call afterwards. In addition to being useful for your function, I’ve found that demonstrating good note taking, and consistently sharing, can encourage others to loop you in more regarding customer insights they come across or opportunities to participate.

You’ll also benefit from using tools to document what customers say, run surveys, or manage other activities related to your Voice of the Customer program. You likely already have some relevant tools (even as simple as Google Docs), and it may help to incorporate additional ones. Don’t let a lack of tools keep you from getting something off the ground though, as you can work on optimizing over time.

Be mindful of potential pitfalls:

- Asking too much of customers, such as frequent surveys or invitations to have calls. For example, systems could be set up to automatically ping customers (e.g., NPS or CSAT surveys), possibly on a recurring basis, so be mindful of who is targeted by such things and how often before trying something new that’s customer-facing.

- Collecting a lot of data and not doing much with it. If you’re going to invest in a Voice of the Customer program — while getting buy-in and participation across the company, you’d better follow through and extract the value that it can provide. Starting small is fine, and make sure you follow through so you can build on it.

- 💡 Start small by adding insights in a Google Doc and sharing the doc with teammates. When the process picks up steam, you can make the doc look better (e.g., add sections with a table of contents) or move the content to a different tool that might be preferred for centralized documentation.

- 💡 Start small by adding insights in a Google Doc and sharing the doc with teammates. When the process picks up steam, you can make the doc look better (e.g., add sections with a table of contents) or move the content to a different tool that might be preferred for centralized documentation.

- Not closing the loop. If you work with members of your company to collect, analyze, and/or action customer insights, sharing updates about what you’ve done or plan to do will go a long way in supporting a repeatable process for everyone.

It’s great if you currently listen to customer feedback, and if you use what you learn to inform priorities and plans. This is valuable and should continue. If you encompass that approach into a Voice of the Customer program — while also doing additional things such as what’s mentioned in this blog post, then you can likely create more value — based on a higher volume and greater depth of customer insights that can potentially result.

If you believe this is worth doing, you’ll need to determine who is best to organize it in your company, and who should be responsible for acting on the findings.

In my view, it doesn’t matter which department or function owns the program, as long as someone is the clear owner. A natural fit could be ownership by Product Management, Product Operations, Product Marketing, Customer Success, COO, or something along these lines.

Once team member involvement is coordinated and people know the process to follow, the program can run async — aside from meetings designed to collect, analyze, or share customer insights. The person who owns the program should periodically check on how things are going and offer help to clear blockers or implement improvements.

When things go in a positive direction here, outcomes could include a better customer experience, increased customer loyalty, more revenue, and even higher employee retention if done in as cross-functional a way as I advocate for. Doesn’t now sound like a good time to get Voice of the Customer started at your company?

Thanks to Mik Pozin for providing early feedback on this post